Corporate Finance

Business Valuations

The topic of business valuation is frequently discussed in corporate finance. Business valuation is typically conducted when a company is looking to sell all or a portion of its operations or looking to merge with or acquire another company. The valuation of a business is the process of determining the current worth of a business, using objective measures, and evaluating all aspects of the business.

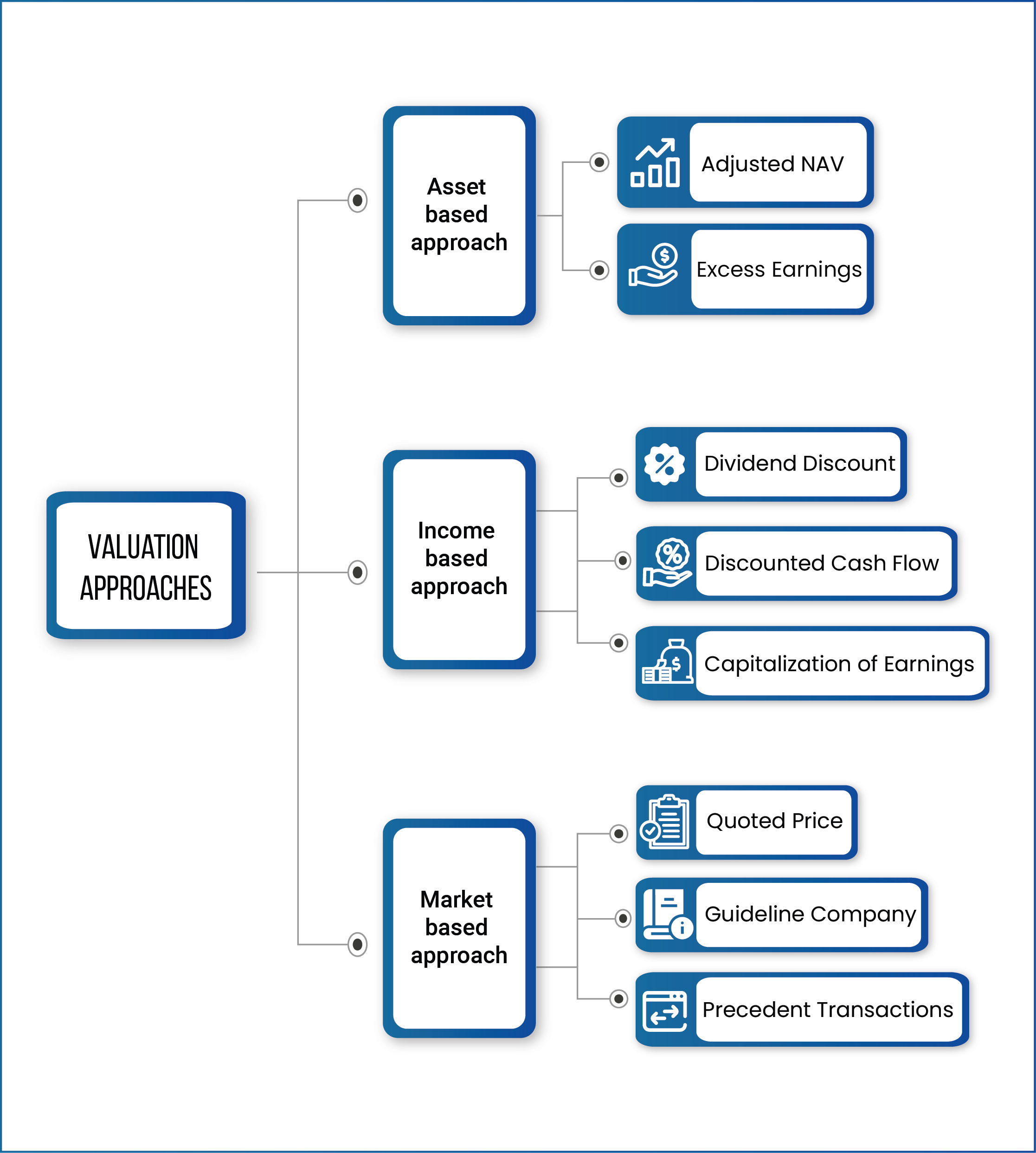

A business valuation might include an analysis of the company’s management, its capital structure, its future earnings prospects or the market value of its assets. The tools used for valuation can vary among evaluators, businesses, and industries. Common approaches to business valuation include a review of financial statements, discounting cash flow models and similar company comparisons.

QUESTIONS THAT OUR VALUATIONS TEAM CAN HELP ANSWER:

- What is the current market value of my business?

- What is the most appropriate valuation methodology to employ when assessing the value of my business?

- What are the key value drivers and how can I increase value going forward?

- If I have a target valuation in mind, what do I need to do to achieve it and how long will it take?

Corporate Finance

Business Valuations

Valuation Overview

These factors include the pattern of historical performance and earnings, the company’s competitive market position, the quality and depth of management, marketability and others.

There are many factors that must be considered when valuing a business enterprise which include:

- Nature and history of the business;

- General economic climate and industry conditions;

- Earnings, cash generation and dividend-paying capacities;

- Sales of the shares and the size of the block to be valued; and

- Market value of the shares of the companies engaged in the same or a similar line of business.

QUESTIONS THAT OUR VALUATIONS TEAM CAN HELP ANSWER:

- What is the current market value of my business?

- What is the most appropriate valuation methodology to employ when assessing the value of my business?

- What are the key value drivers and how can I increase value going forward?

- If I have a target valuation in mind, what do I need to do to achieve it and how long will it take?

Our valuations team has cross sector experience and has recentlyworked on valuations relating to IPOs, significant capital raises and purchaseprice allocations…

Valuation Analysis

In our valuation analysis, we considered two generally accepted valuation approaches used to value a business:

- Income Approach.

- Market Approach.

While each of these approaches may be initially considered in the valuation, the nature and characteristics of the subject business and the objective of the valuation analysis indicates which approach, or approaches, are most applicable.